Family Travel Insurance Guide 2025: What to Know Before You Go

Planning long-term travel with your family? This guide breaks down everything you need to know about family travel insurance including what it covers, how it works across borders, and why we chose SafetyWing as our provider for 2025.

What Is Family Travel Insurance and Why You Actually Need It

Planning a long-term trip with kids? Here’s why travel insurance matters more than you think and how it protects your family when the unexpected hits.

What Is Family Travel Insurance?

Family travel insurance is a type of coverage designed to protect parents and children traveling together, usually under a single policy.

It typically includes emergency medical care, trip cancellations, delays, lost luggage, and sometimes evacuation or repatriation. For families preparing for extended travel, it also gives peace of mind that you’re not one broken arm or canceled flight away from major financial stress.

Unlike basic insurance for solo travelers, family plans often include free or discounted coverage for children (Boom, sounds like a win) flexible dates, and additional benefits for dependents.

Many providers, including SafetyWing, allow you to insure multiple children under 10 at no extra cost, which can significantly reduce your overall expense.

Why You Actually Need It (Even If You’re “Healthy”)

Many families think: “We’re all healthy, we don’t need this.” But travel insurance isn’t just about major emergencies. It’s also for:

A toddler getting sick mid-flight (trust us, this can happen)

A missed connection that delays you 24 hours

A house sit that gets canceled last-minute

A stolen stroller in Buenos Aires

Rebooking fees, clinic visits, or lost luggage chaos

If you’re travelling long-term, especially across borders, your home health insurance won’t cover you. That includes many credit card policies, which often exclude dependents or extended stays.

Think of travel insurance as your backup plan for unpredictable moments and a key part of feeling free to enjoy the adventure we all crave to have.

What Does Family Travel Insurance Cover?

It’s not just about hospital stays or lost luggage, here’s exactly what family travel insurance usually covers, and what to double-check before you buy.

Core Coverage You Can Expect

Most family travel insurance policies are designed to protect you across four key areas:

Emergency medical care

Coverage for illnesses, injuries, clinic visits, and hospital stays while abroad. Some policies even include dental emergencies (read the fine print).Trip interruption or cancellation

Reimbursement if you have to cancel due to illness, injury, or a covered reason (like natural disaster or political unrest). Helpful when traveling with young kids, who get sick at inconveniently precise times.Baggage loss, delay, or theft

Covers the essentials if your bags go missing, think replacement clothes, baby gear, or meds. Some plans cover strollers and car seats, too.Emergency evacuation and repatriation

Covers transport to a medical facility (or back home) if needed. Crucial for remote travel or when crossing multiple countries.

What Counts as a “Family”?

Definitions vary, but most plans include:

One or two parents or guardians

Children under a certain age (often 10 or 14)

Some allow for step-parents, grandparents, or legal guardians

Kids must often be travelling with the covered adult(s) to be eligible

For example, SafetyWing covers up to two children under 10 per insured adult, free of charge. That’s a big cost-saver if you’re travelling as a family of four (As long as they do not have a pre-existing condition)

Before buying, check if coverage is per person or per group, and confirm what’s considered a dependent. Every plan structures this slightly differently, especially when travel is long-term.

Travel Insurance Free for Kids? (And Other Cost-Saving Truths)

Traveling as a family adds up fast but the right insurance plan can actually save you money. Here’s what we found out about free kid coverage (and what’s not included).

Can Kids Get Free Travel Insurance?

In some cases, yes, but not always.

Certain providers include free coverage for children under a set age when they’re travelling with an insured adult. For example, SafetyWing covers up to two children under 10 per adult at no extra cost. That’s huge for families trying to stretch every dollar (or peso, or sol).

But don’t assume every plan does this. Many “family” policies still charge per person, especially if you book through airline add-ons or basic package insurers. Others may offer discounted child rates, but with reduced coverage or hidden exclusions.

Age Limits to Watch

Free or discounted kid coverage usually applies to:

Children under 10 (SafetyWing’s limit)

Sometimes up to 14 or 17, depending on the provider

Must be listed on the policy and travel with the parent

Often excludes unaccompanied minors or teens travelling solo

Always check the policy wording to confirm the age threshold and whether “free” actually means fully covered, or minimal coverage with gaps.

Bonus Tip: Start the Policy Before They Turn the Cutoff Age

Some insurers honour the child rate or free coverage as long as your policy begins before their birthday, even if they age up mid-trip.

That’s a small trick that can save you money and confusion if you’re planning long-term travel with kids hovering near a cutoff.

Why We Chose SafetyWing for Our Family

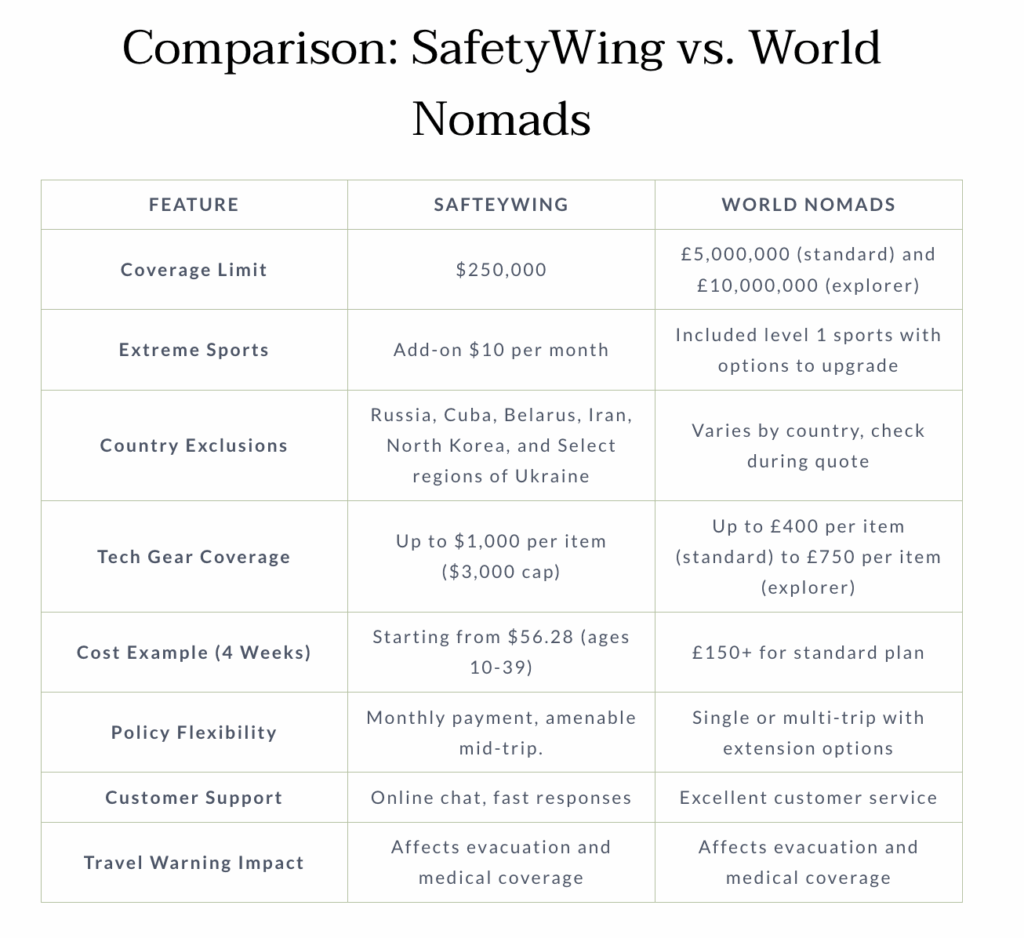

We looked at the usual travel insurance options, but most felt built for short trips or solo travelers. SafetyWing Travel Insurance stood out because it actually makes sense for families — especially those traveling long-term.

What Made SafetyWing Different

When we started planning a year of travel with two kids, we realised most travel insurance didn’t fit our situation. Some providers were fine for a 10-day holiday, but once you throw in multiple countries, flexible dates, and children, it got complicated fast.

SafetyWing won us over for three big reasons:

Kids under 10 are covered for free, up to two per adult. That’s a rare (and welcome) cost-saver.

You can buy it after leaving home – perfect if plans change or you’re already on the road.

It runs like a subscription- you pay monthly and cancel when you don’t need it anymore. No need to guess how long you’ll be gone.

We also liked that their whole platform feels designed for digital nomads and families alike, not just backpackers or business travellers. It gave us a buffer without the usual red tape or stress.

What It Costs Us (And What It Covers)

For our family of four (two adults, two kids under 10), we pay around $90–$160/month total, depending on currency changes and plan add-ons.

That includes medical coverage, trip interruption, travel delay, lost luggage, and emergency evacuation in every country we plan to visit. We also get access to their Borderless tool for visa planning and perks like 24/7 support.

What SafetyWing Covers (And What It Doesn’t)

No insurance covers everything. But knowing exactly what’s included and what’s not, can help you avoid nasty surprises while you’re halfway across the Andes.

What’s Covered by SafetyWing

SafetyWing’s Nomad Insurance (which we use) includes:

| Coverage | Included? | Notes |

|---|---|---|

| Emergency medical treatment | ✅ | Includes hospital stays, illness, accidents |

| Emergency evacuation | ✅ | Medical transport if local care isn’t sufficient |

| Travel delay | ✅ | Covers unplanned costs due to delays (e.g. hotels, meals) |

| Lost checked luggage | ✅ | Up to $3,000 per policy period |

| COVID-19 treatment | ✅ | Treated as any other illness if contracted during travel |

| Emergency dental | ✅ | $1,000 coverage for sudden pain, infection, or injury |

| Natural disasters | ✅ | Trip interruption, lodging replacement if affected |

| Kids under 10 | ✅ | Up to 2 per insured adult, free of charge |

What’s Not Covered

Like all insurance, there are limits. SafetyWing Travel Insurance doesn’t cover:

Pre-existing medical conditions (unless stable for 2 years)

High-risk sports like base jumping, scuba diving past depth limits, etc.

Routine checkups or vaccinations

Pregnancy care after week 26

Electronics or valuables beyond certain limits

Lost passports or visas

Non-emergency dental or vision

And while it does cover travel to your home country for brief visits, long-term care or elective treatment at home isn’t included.

Pro tip: Read the fine print before you buy (Yes boring but…) it’s all clearly laid out on their site, and you can even chat with their support team if something’s fuzzy.

Tools We Used to Choose a Plan

With so many insurance options (and fine print that makes your brain melt), we needed tools that made the choice clearer, especially for family travel. Here’s what actually helped us decide.

1. SafetyWing’s Borderless Tool

This is more than a visa checker — it’s a real-time travel compliance dashboard. We used it to:

See which countries required proof of insurance

Double-check entry requirements for kids

Flag any destinations that might affect coverage or cost

It’s especially useful if you’re traveling through South America or Europe, where border policies can shift unexpectedly.

2. Comparison Spreadsheet (Our Own)

We made a simple Google Sheet to compare:

Cost per adult/month

Kids included or not

What’s excluded (especially dental + electronics)

Whether we could start coverage after leaving the UK

Home-country visits allowed?

These are super easy to do, we have it in our family travel planner, this is included in our Family Travel Kickstarter Kit.

3. Reading Reddit, Quora & Family Travel Forums

We searched:

“Is SafetyWing good for families?”

“What happens if you get sick on Worldschooling trips?”

“Insurance for kids on long-term travel?”

We used Reddit a lot and saw firsthand reviews from other nomad parents, and also spotted gaps in coverage with other providers that helped us filter out poor fits.

4. The SafetyWing Site (Perks & Policy Pages)

Their transparency helped, plain language, real support chat, and bonus tools like Perks that give access to:

Remote doctor consults

Mental health support

Prescription discounts

(Again, super useful with kids in the mix.)

How to Buy SafetyWing (Step-by-Step With Tips)

Buying travel insurance shouldn’t feel like doing your taxes. Here’s exactly how we signed up for SafetyWing — and what we learned along the way.

What You’ll Need Before You Start

Make sure you have:

Full names and dates of birth for each traveller

Your home country and first destination

Trip start date (you can set this as today if you’re already travelling)

A credit card or an international payment method

If you’re travelling as a family, remember: you’ll need to list each adult separately, and eligible children will be automatically added (up to 2 per adult, under 10 years old).

Step-by-Step: Buying SafetyWing

Go to SafetyWing’s website

Click “Get Insured” and enter your travel details

Select “Nomad Insurance” and the duration (monthly auto-renewal is the default)

Add each adult traveller

Confirm that eligible kids are listed beneath the parent policy

Review coverage summary

Pay and receive policy documents instantly via email

You can start coverage while already abroad, no need to be in your home country.

Tips from Our Experience

Set a reminder a few days before your renewal date in case you need to pause or adjust the plan

Double-check coverage for countries you’re transiting through, not just final destinations

Contact their support chat — they’re fast, helpful, and actually human

We had questions about coverage for dental and house-sitting scenarios, and they responded within minutes.

Creator-to-Creator — How the SafetyWing Referral Program Works

If you’re a travel blogger, creator, or just someone sharing what works — this might be one of the easiest ways to earn passive income while helping others prep smart.

Why We Signed Up as Ambassadors

When we realised we’d be talking about travel insurance anyway, especially with other families prepping for big trips, it made sense to join SafetyWing’s creator referral program.

It’s free, easy to join, and they actually reward both sides, which we love.

How It Works:

You share your unique link (like this one here)

If someone signs up using your link and makes a qualifying referral, you both earn $100

If they refer five others, you both earn a $500 bonus

There’s no cap to how many people you can refer

You can track it all in a clean dashboard

“It’s a win-win, we get rewarded for being helpful, and our friends or audience do too. It’s honestly the first affiliate program that felt aligned with how we actually travel and share.”

Who It’s For:

Travel bloggers

Worldschooling families

House-sitters

Freelancers or digital nomads

Anyone helping others navigate long-term travel

Want in? You can apply here

Our Travel Insurance Packing Checklist

It’s one thing to buy the right plan. But when things go wrong, having the right documents fast, can make all the difference. Here’s what we keep on hand when we travel as a family.

Essential Docs We Keep (Digital + Printed)

Item

| Why It Matters |

|---|---|

✅ Policy confirmation PDF. | Needed to make claims, show proof at borders |

✅ Emergency contact numbers | Local embassies, SafetyWing’s support, local clinics |

✅ Copy of passport + ID | Vital if a bag or wallet is lost |

✅ Kids’ birth certificates | Some countries require proof of parentage when travelling |

✅ Health records or allergy info | Especially important for kids with ongoing conditions |

✅ Prescription list | In case meds get lost or you need refills abroad |

✅ Vaccination records | Some countries or school programs ask for these |

✅ Travel itinerary snapshot | Useful if you need to explain where you’ve been/stayed |

We keep one printed version of everything in a waterproof zip pouch in our daypack, and a digital version in a shared Google Drive folder that we can access offline.

Final Thoughts: Why Insurance = Freedom, Not Fear

We didn’t buy travel insurance because we’re worriers. We bought it so we could stop worrying.

Travelling as a family is exciting, but it’s also chaotic, unpredictable, and (let’s be real) expensive. For us, having insurance was never about expecting disaster. It was about knowing that if something did go sideways, we wouldn’t be stuck, panicked, or out thousands.

SafetyWing gave us a way to plan responsibly without overcomplicating things. It’s flexible, built for long-term travel, and let us cover our kids without doubling our budget.

We hope this guide gave you a clear view of what family travel insurance actually covers, how to choose the right plan, and why SafetyWing made the most sense for us. Whether you’re prepping for a year abroad, a few months of worldschooling, or just a big summer with the kids, insurance is the one line item that lets the rest of the adventure unfold with confidence.